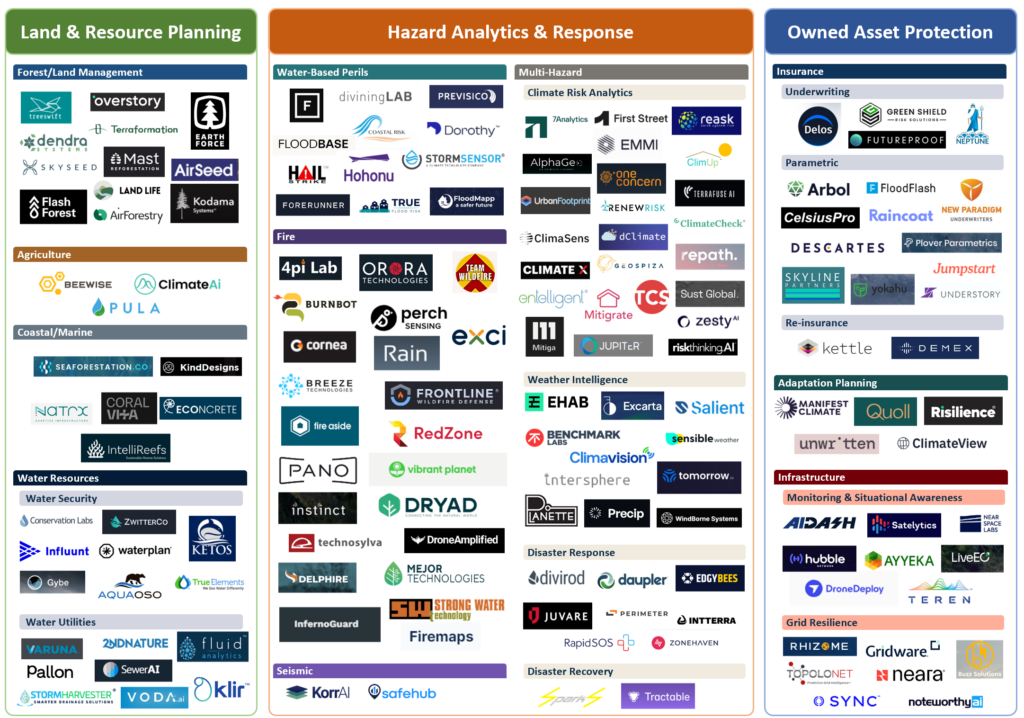

A market map of tech solutions for climate adaptation and resilience

By Joey Barrick

Annual record-setting in the climate crisis is becoming the new normal. This year is on pace to be the hottest ever recorded. Last year saw a record number of weather events that caused more than a billion dollars in damages.

Investing in climate mitigation strategies is essential to, well, mitigating climate impacts. But we must also prioritize adaptation and resilience technologies and strategies to ensure our infrastructure, communities and economies are prepared.

Climate adaptation and resilience is greatly underinvested, accounting for just 5% of climate finance. We are now seeing private adaptation and resilience investments pick up, however, thanks to a drumbeat of data and research from the Global Adaptation and Resilience Investment working group (GARI), the White House, Tailwind Climate and others making the case.

At SJF Ventures, which has been investing in carbon emissions reductions for more than two decades, we are also now shifting to support more innovations in climate adaptation and resilience.

Adaptation and resilience tech themes

To support our work and other investors, we mapped the current landscape of companies working in climate adaptation and resilience. Many companies touch on multiple areas, but we’ve identified three major themes – hazard analytics and response, resource preservation, and owned-asset protection – and several prominent sub-categories such as climate risk analytics, climate insurance, fire tech, and water resource management.

Climate risk analytics

The initial wave of climate adaptation and resilience investing was largely driven by climate risk analytics. The sector emerged due to a growing need for business decision-makers to assess the future effects of climate change in strategic planning processes and compliance reporting. Climate risk analytics companies offer software products that provide short- to long-term forecasting of extreme weather events.

Early investors supported companies like The Climate Service (acquired by S&P), Jupiter Intelligence, and Four Twenty Seven (acquired by Moody’s). Climate X, First Street, and XDI are other notable venture-funded companies in this segment.

Weather intelligence investments followed, as a gap emerged between short-term planning and actionability for discrete weather events and long-term planning for a changing climate. While climate risk analytics and weather intelligence modeling are related, they are distinct: weather intelligence typically focuses on short-term, day-to-day operations, whereas climate risk analytics takes a longer-term view. Early Jupiter Intelligence employee, Matt Stein, founded Salient Predictions to focus on enhancing the accuracy of the two to 52-week weather forecast. Tomorrow.io focuses on real-time, hyper-local weather forecasts. EHAB takes an industry-specific strategy, linking its weather risk platform to reducing delays in construction and operationally heavy industries.

New innovators are incorporating the latest advances and capabilities of artificial intelligence, given the astounding accuracy of AI-enabled weather predictions, as shown recently with Hurricane Beryl. We’re also seeing the intersection of climate mitigation and adaptation themes in new tech solutions, such as ReSurety’s WeatherSmart offering that predicts the performance of wind and solar projects.

Insurance tech

Numerous climate-focused insurance tech startups emerged in conjunction with early climate risk analytics offerings, since many climate risk analytics solutions targeted the insurance industry – even before the SEC rule on climate risk disclosures.

The current framework for insurance underwriting leaves primary insurers with limited options to address worsening “high frequency” weather events. The result is a disheartening trend of insurance companies exiting markets, citing unsustainable losses as the driving factor.

As areas become increasingly difficult to insure profitably, innovative solutions in both insurance (FloodFlash for parametric flood insurance, Understory for hail insurance), reinsurance (Demex for severe convective storms, Kettle for wildfires) and other adjacent efforts are urgently needed to address the growing insurance gap and protect vulnerable communities.

It’s also worth noting the role of public sector and nonprofit organizations in this space from OS-Climate, the National Oceanic and Atmospheric Administration, the EU’s Copernicus Programme, the open-source catastrophe modeling platform Oasis Loss Modeling Framework and others.

Fire tech

The second big climate adaptation wave we noticed has focused on addressing wildfire risks, with investments rising after the 2020 California wildfires. Convective Capital raised a fund to support companies addressing wildfire risk in the wake of that disorienting wildfire season. Burnbot, Pano and Rain have made notable advances in wildfire detection, response and mitigation.

FIre tech largely focuses on responding to wildfire events or reducing their likelihood, but we’re also seeing startups take a long-term view of wildfire risk in the broader context of forest and land management. They’re tackling challenges like efficient wildfire recovery, land resilience efforts, and better management of vast land resources. Companies are developing tech solutions for reforestation and land restoration (AirSeed, Dendra Systems, Mast Reforestation and Terraformation), streamlining forest and land management (Earth Force and Kodama) and advanced analytics (Treeswift).

Water resource management

Our fundamental dependence on water in a changing climate has made managing water resources—both too much and too little of it—increasingly difficult (check out the aptly named podcast from Burnt Island Ventures’ “The Fundamental Molecule”). Flood risks are the undisputed headliner here. Companies like Fathom and First Street are rolling out solutions for better flood prediction, and Floodbase and Hohonu are among those working on flood monitoring.

Much of what’s happening in the market overlaps with the insurance tech trend, but other water-related issues are also getting attention. Municipalities, utilities and industrial-scale water users need improved capacity to handle increased pressure on their systems. We’re seeing an emergence of innovation across water treatment (Zwitter), water risk (Aquaoso and Waterplan), water quality (bNovate), and software platforms (Klir and SewerAI) aimed at helping water utilities, industry and agriculture adapt to future uncertainties.

Nonprofits play a key role in advocacy and providing data. The World Resources Institute, for example, has developed the Aqueduct platform to highlight water risks globally.

Climate risk planning

As the climate adaptation and resilience tech field matures, more value will be placed on quantifying and informing businesses and consumers about flood, fire and other extreme weather risks to homes, properties and other assets. We’re seeing an emerging group of startups targeting a wide range of sectors, with examples like Rhizome for power utilities, First Street for homeowners and businesses, Unwritten for finance, and ClimateView for local governments.

Infrastructure and asset management

Also, a new generation of infrastructure asset management is arriving. Real-time monitoring is a key theme across asset classes, including the electricity grid, energy, transportation, pipelines, water, and more. Startups like AiDash, Ayyeka, Drone Deploy, Gridware, Hubble Network and LiveEO are leveraging a combination of connected devices, drones, satellites, and analytics to provide real-time situational awareness of critical infrastructure. Some of these platforms can even predict faults and outages.

We’re hoping to see more solutions that can provide actionable intelligence from monitoring. It will be exciting to see how these innovations strengthen infrastructure asset management in the future.

Proactive engagement

Many large property and asset owners and operators like JLL, CBRE and Cushman & Wakefield have started quantifying the flood, fire, heat, wind and seismic risks across portfolios for clients, regulators and shareholders. They may begin to quantify latent financial risks associated with those properties, both in terms of property value at risk and the (often more pronounced) business interruption risk.

The logical next question is: what can be done proactively to reduce risks, costs and damages?

Global engineering firms like Arup, WSP, AECOM and others are developing specialist adaptation and resilience teams to help property owners consider both physical and operational interventions like renovations for resilience and mitigation or relocations of critical business units. Indeed, Arup building on their early work in seismic risks and mitigation, Arup recently published “A universal taxonomy for natural hazard and climate risk and resilience assessments“.

Similarly, global insurance firms like Marsh and Aon often consult on managing risks and providing coverage. Global reinsurance firms are beginning to offer software externally for assessing climate risk, such as the Location Risk Intelligence offering from MunichRe.

Some climate risk analytics companies cited are now offering recommendations for adaptation and resilience strategies for large asset portfolios. Such adaptation and resilience intelligence software and technologies are also needed for the public sector to assure that schools, hospitals and communities take cost-effective steps to manage future climate disruptions.

Where we’re headed

We need a measuring stick for climate adaptation and resilience.

In climate mitigation, the focus on reducing or removing greenhouse gas emissions has made impact crystal clear. All goals around cargon mitigation can be summed up in one term: net-zero.

In contrast, metrics and KPIs for adaptation and resilience are often less clear, making it challenging to evaluate technologies and their associated impacts. One potential solution is to measure total “value at risk” from climate events, allowing companies to measure returns on investment in terms of their ability to reduce value at risk.

It can also be challenging to quantify the ROI of adaptation and resilience projects. Showing value creation for customers and communities could unlock untapped demand for adaptation and resilience projects. This may include reducing the “value at risk” on a portfolio of adaptation and resilience investments, and eventually showing reduced insurance premiums (though this is more challenging).

So what’s next?

Early climate adaptation solutions were driven by compliance and regulation, such as the SEC’s rule on climate risk disclosures. As climate risk data becomes more widely available, every household in the US can identify their residence’s key climate risks. We hope to see more innovation that seeks to actively mitigate risk.

We also need and want to see more solutions for vulnerable and underserved communities. Most of today’s solutions for adaptation and resilience are accessible only to those homeowners, companies or markets that can afford them, leaving others to suffer through floods, fire, wind and heat.

At SJF, we are looking for companies that serve the broader population in part by enabling more effective government services and infrastructure improvements.

We also hope to see innovators pursue opportunities to integrate adaptation and resilience measures into more comprehensive solutions, given the many ongoing efforts to achieve net zero. For example, if a building is being retrofitted with heat pumps or new windows or insulation, anticipating flood, heat, wind and fire risks to “future proof” the building makes sense.

For large scale infrastructure like solar power plants, we similarly need to anticipate and protect against hail events. And for public infrastructure, new FEMA rules require assessing future flood and climate impacts with new or rebuilt facilities.

There’s a lot of work to be done on adaptation and resilience, and we all need to be more connected, whether you’re an entrepreneur tackling any of these problems, an academic with a hot take, or are generally just interested in making the next 100 years a little more hospitable.

—

Many thanks to Brian Wong, recent Duke Fuqua MBA grad, who helped us to scope out this market landscape earlier this year and to Dave Kirkpatrick for guiding our work. For further revisions or referrals, contact Joey Barrick with SJF.