SJF Ventures Creates First Portfolio Carbon Impact Model

Joint project standardizes and aggregates CO2 impacts of portfolio companiesIn 2016, SJF Ventures undertook a project to better understand the climate change impact of its portfolio. Since 1999 the fund has sought to catalyze the development of high growth, positive impact businesses and has helped generate a diverse set of employment, community and environmental impacts. As highlighted by the recent Paris Agreement signed in April 2016 by 181 nations, greenhouse gas emissions mitigation is an urgent priority. To assess this critical aspect of investment impact, SJF Ventures worked with a team from the Center for the Advancement of Social Entrepreneurship (CASE) at Duke’s Fuqua School of Business, along with its partners at the Duke Carbon Offset Initiative and with review by the Environmental Capital Group, to create a dynamic model illustrating how and where SJF’s portfolio companies reduce carbon emissions. With this report, SJF’s annual carbon mitigation impacts are now being quantified and aggregated at the fund level, and SJF is proud to be one of the first venture capital firms to study and report on the carbon impact of its portfolio.

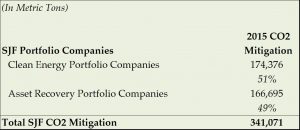

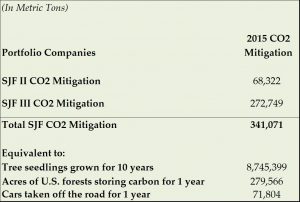

Using portfolio company data and various third-party CO2 emissions research, the Duke project team standardized carbon impact across the portfolio and calculated that SJF Ventures portfolio companies helped mitigate over 341,000 metric tons of CO2 in 2015, which is equivalent to removing 71,000 cars from the road for a year or planting 8.7 million trees.

Scope of portfolio carbon emissions mitigation model

To gain an initial understanding of the portfolio’s emissions mitigation, the project team developed a model that measures impact in metric tons of carbon dioxide emissions avoided through the work of the nine SJF Ventures portfolio companies with energy and materials intensive business models. The Duke team focused on those portfolio firms in two of SJF’s six priority impact areas: clean energy/energy efficiency and asset recovery.

Highlighted clean energy firms include Community Energy (renewable energy developer), EnTouch Controls (energy management systems for restaurant and retail chains), groSolar (solar EPC and developer), and NEXTracker (solar tracking systems.) Within asset recovery, the project covered firms focused on source reduction, landfill diversion, reuse and recycling, including BioSurplus (lab equipment life cycle management), HYLA Mobile (mobile device trade-in and reuse solutions), Living Earth (organic waste recycler), Novinium (underground power rejuvenation), and Optoro (reverse logistics platform.)

The team also identified probable positive carbon impacts from other SJF Ventures portfolio companies, including Aseptia (food processing technology), Ayla Networks (Internet of Things platform), FieldView Solutions (data center management software), Versify Solutions (power generation optimization software) and Vital Farms (pasture-raised eggs), but was ultimately unable to include these companies in the 2015 model due to insufficient data available. It is SJF’s hope that further work can be done in 2016 to help these companies advance their data collection capabilities and further expand the portfolio company coverage in the carbon impact model. Future reports will also include new portfolio investment with major carbon reduction results, such as TransLoc which helps increase ridership and efficiency in mass transit.

The carbon mitigation calculations used in the model are not complete greenhouse gas accounting, but rather attempt to provide gross carbon mitigation amounts from SJF portfolio companies’ primary business operations. Impact calculations noted below follow standard industry practices and report total impact for the portfolio company, not pro rata contribution based on SJF’s ownership stake.

The project team developed a model to take company-specific input data related to the company’s primary business function (i.e. kilowatts renewable energy output, tons of waste diverted from landfill, amount of materials conserved from source reduction, etc.) and use calculations from the EPA and other third-party scientific studies to calculate equivalent carbon emissions mitigated.

Measuring carbon impact of clean energy investments

Replacing fossil fuel-based energy sources with renewables reduces CO2 emissions from electricity generation. SJF renewable energy companies enable clean power to electric power grids from utility-scale solar project development; engineering, procurement and construction (EPC); and solar system hardware components, like solar trackers. The portfolio carbon model converts kilowatt-hours of solar power production each year enabled by SJF portfolio companies to tons of CO2 mitigated using CO2 factors from the U.S. Energy Information Administration and controlling for geography and capacity by facility measured.

Reducing electricity usage from the primarily fossil fuel-based power grid also reduces CO2 emissions. SJF portfolio company EnTouch Controls provides energy management systems for restaurant and retail chains, which have very high energy intensity per square foot facilities. Energy savings were calculated using a representative group of restaurant and retail client facilities as a proxy for other clients that lacked sufficient data. The model captured baseline energy usage levels for client facilities prior to the installation of EnTouch Controls hardware and software controls systems and compared that with energy usage after installation. Total kilowatt-hours saved were then converted to tons of CO2 mitigated.

Measuring carbon impact of asset recovery investments

The carbon emission mitigation of recycling and reuse is less well-known but is nonetheless substantial. Reuse and recycling models of course generate waste savings, but carbon impacts in this category also derive from three potential avenues: source reduction from avoided new manufacturing, emissions from waste in landfills (some of which have gas recovery practices) or incineration, and reduced transportation of materials.

SJF asset recovery companies leverage innovative sales channels and operational models to divert reusable, resalable, and recyclable products from waste streams. The carbon model quantifies these companies’ provision of an alternative to waste, taking into consideration the three potential avenues for CO2 savings and applying only those that fit the specific company’s model.

In the case of SJF’s companies focused on reuse, major CO2 savings occur given the opportunity to decrease manufacturing of new materials, including metals, glass and plastics used in laboratory equipment, mobile devices and underground power cable. For SJF portfolio company Living Earth, an organic waste composting company, most of its CO2 mitigation stems from landfill emissions avoidance. The model utilizes the EPA’s Waste Reduction Model (WARM) calculator for energy factors of specific materials as well as the Electronics Environmental Benefits Calculator (EEBC) developed by University of Tennessee under cooperative agreement with the EPA; a University of California, Santa Barbara life cycle assessment for underground power cable; and other proprietary transportation savings calculators to convert kilograms of materials reused and recycled into CO2.

The project model identified the carbon mitigation from SJF’s asset recovery companies to be 49% of the 2015 total within its portfolio. The SJF Ventures team as well as the companies themselves were surprised but pleased to note the significant carbon emissions mitigation from asset recovery. The firm hopes to further study these impacts in the years ahead.

2015 Results and next steps

For the past seventeen years SJF Ventures has partnered with companies focused on simultaneous growth and positive impact. Through this project conducted by a team from Duke’s Fuqua School of Business along with its partners at the Duke Carbon Offset Initiative and reviewed by the Environmental Capital Group, sources of environmental impact in SJF’s portfolio were identified and calculated to show optimistic CO2 mitigation results. In 2015 alone, SJF investments have enabled carbon mitigation of more than 341,000 metric tons, which is equivalent to removing 71,000 cars from the road for a year or planting 8.7 million trees.

SJF Ventures is working with portfolio companies to incorporate and interpret findings back into their business and to their customers, bringing ever-greater awareness of carbon mitigation-related issues to a broader set of stakeholders. One example of this is Novinium, which demonstrated especially strong CO2 savings from avoided new underground cable and associated metal and raw material production. Novinium can now use this information with its utility customers to help argue both the economic and climate change impacts associated with its cable rejuvenation technology.

The SJF Ventures team is committed to continued impact assessment and greater climate change outcomes. While the project led by Duke has completed its work, SJF Ventures will continue to refine and build out the CO2 calculation model and continue to work in partnership with companies equally dedicated to creating a cleaner, healthier, and smarter future.

Research and References

Portfolio companies assessed:

Clean energy and efficiency:

Asset recovery and reuse:

Organizational references and review of SJF methodology:

- The Center for the Advancement of Social Entrepreneurship (CASE) at Duke University’s Fuqua School of Business

- The Duke Carbon Offsets Initiative (DCOI)

- Environmental Capital Group, Cliff Brown

Direct references on methodology/assumptions:

- S. Energy Information Administration “Energy-Related Carbon Dioxide Emissions at the State Level, 2000-2013”

- S. Environmental Protection Agency (EPA) Waste Reduction Model (WARM)

- Electronics Environmental Benefits Calculator (EEBC)

- “Life Cycle Assessment of Overhead and Underground Primary Power Distribution.” Sarah Bumby, Ekaterina Druzhinina, Rebe Feraldi, Danae Werthmann, Roland Geyer and Jack Sahl. Bren School of Environmental Science and Management, University of California, Santa Barbara, California.

- Chicago Climate Exchange: Avoided Emissions from Organic Waste Disposal Offset Project Protocol

Other industry research and methodology references:

- Brown, Sally, Matthew Cotton, Steve Messner, Fiona Berry, and David Norem. “METHANE AVOIDANCE FROM COMPOSTING.” ResearchGate, September 15, 2009. https://www.researchgate.net/publication/238724196_METHANE_AVOIDANCE_FROM_COMPOSTING.

- Brown, Sally, Chad Kruger, and Scott Subler. “Greenhouse Gas Balance for Composting Operations.” Journal of Environmental Quality 37, no. 4 (Jul, 2008): 1396-410.

- Damgaard, Anders, Anna W. Larsen, and Thomas H. Christensen. “Recycling of Metals: Accounting of Greenhouse Gases and Global Warming Contributions.” Waste Management & Research 27, no. 8 (November 1, 2009): 773–80. doi:10.1177/0734242X09346838.

- Lou, X.F and J. Nair. “The Impact of Landfilling and Composting on Greenhouse Gas Emissions – A Review.” Accessed October 5, 2016. http://www.sciencedirect.com/science/article/pii/S0960852408010572.

- Mohareb, Eugene A. “Quantifying the Transition to Low-Carbon Cities.” Order No. NR97432, University of Toronto (Canada), 2012.

- Sánchez, A., Artola, A., Font, X. et al. Environ Chem Lett (2015) 13: 223. doi:10.1007/s10311-015-0507-5

- USEPA: Solid Waste Management and Greenhouse Gases: Life-Cycle Assessment of Emissions and Sinks https://nepis.epa.gov/Exe/ZyPDF.cgi/60000AVO.PDF?Dockey=60000AVO.PDF

- Vasan, Arvind, Bhanu Sood, and Michael Pecht. “Carbon Footprinting of Electronic Products.” Applied Energy 136 (December 31, 2014): 636–48. doi:10.1016/j.apenergy.2014.09.074.