SJF Market Analysis Outlines Startups Disrupting Menopause Care, Opportunities for Investors

Menopause has long been overlooked and misunderstood. It is a condition that is, at worst, the butt of jokes and, at best, discussed in whispers. In recent months, however, that narrative has shifted. The New York Times (here, here and here), Bloomberg, and Axios have all called attention to menopause, the severity of its symptoms, and its economic impact. Might this mark a change in the public perception of menopause? If so, it is long overdue.

Nearly 1 billion people are expected to experience menopause, defined as the phase after 12 consecutive months without a period, by 2025.[1] The symptoms of menopause and perimenopause, the phase in which a person’s menstrual cycle becomes erratic or irregular, range from distracting to debilitating. These include hot flashes, incontinence, sleep loss, mood changes such as depression, anxiety, and brain fog, and physical changes such as weight gain or loss, a slowing metabolism, and joint pain. On average, a menopausal person will utilize healthcare resources at a higher rate.[2] The annual global economic impact of menopause, between productivity loss and healthcare costs, is estimated at $150B.[3]

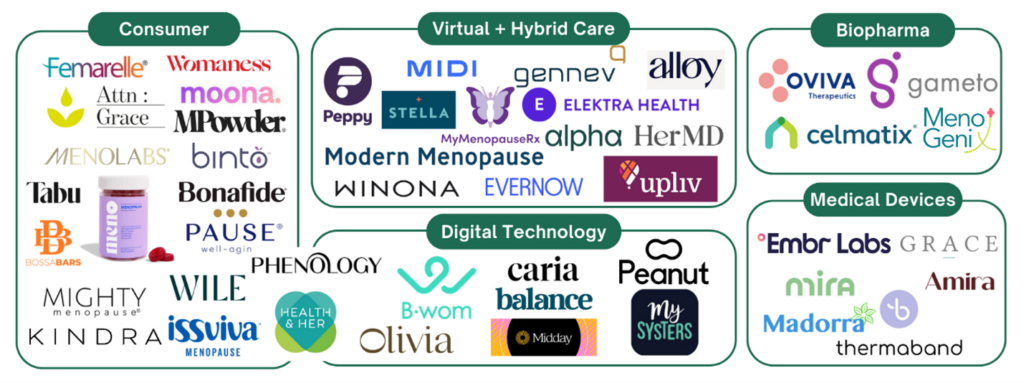

Sectors of Menopause Care

Entrepreneurs are addressing the personal, social, and economic challenges of menopause. SJF Ventures conducted a landscape analysis of these entrepreneurial solutions, identifying 50 companies that we categorized into five sectors: biopharma, consumer goods, digital technology, medical devices, and virtual and hybrid care. These innovations range from therapeutic solutions that lengthen ovarian health, medical devices that cool a body experiencing hot flashes, virtual clinical care that connect patients with physicians who specialize in menopause care, and direct-to-consumer subscription services for hormone replacement therapy.

- Biopharma: Biopharmaceutical and therapeutic solutions to ovarian health and menopause symptoms. Examples include Oviva Therapeutics, which is developing novel therapeutics to address ovarian health and longevity, and Gameto, which is solving diseases of the female reproductive system.

- Consumer Goods: Health supplements, personal care, and sexual wellness products for aging women. Bonafide Health, for example, provides hormone- and prescription-free health products for menopause symptoms.

- Digital Technology: Platforms for menopause management, including symptom tracking, educational resources, and social networks. Midday is a personalized menopause app to help people manage their menopause symptoms and midlife health.

- Medical Devices: Devices or wearables that alleviate menopause symptoms such as hot flashes and vulvovaginal atrophy. Embr Labs has created a personalized cooling device for hot flashes.

- Virtual and Hybrid Care: Clinical care, including consultations and medications, for menopause symptoms. Elektra Health provides clinical and non-clinical care, educational content, and social networking. Stella is an online clinic that provides treatments for menopausal symptoms, including hormone replacement therapy (HRT).

Investment Landscape

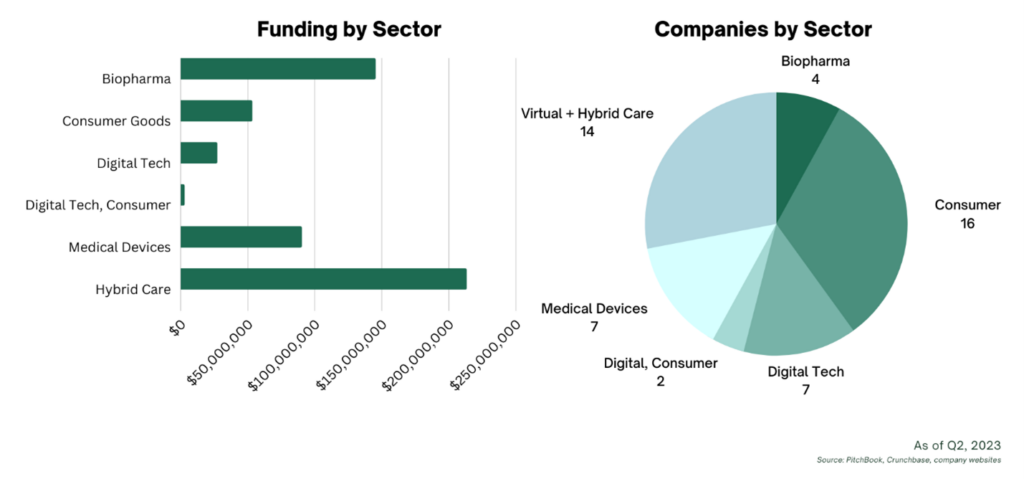

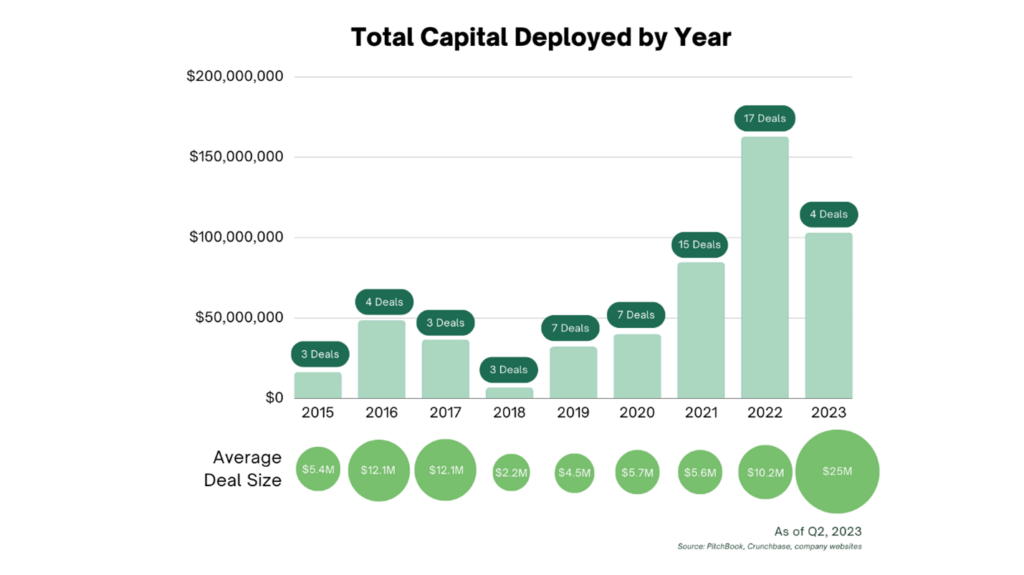

Per PitchBook and Crunchbase data, startups addressing menopause care were first funded in the mid 2010’s. Since then, approximately $530M has been deployed over seven years, from 2015 to Q1 2023 (this excludes large health-tech companies like Everlywell and Maven Clinic, which offer menopause care as part of a suite of services). While $530M may seem substantial at first glance, it is a drop in the bucket of VC funding. As a point of comparison, fem-tech startups received $1.9B in 2021. Which means all menopause care investments account for just 3% of fem-tech funding from one year. In the same year, digital healthcare companies received $30.7B.

Of the $530M deployed in menopause care, about $210M has been invested in virtual and hybrid care, and another $145M has been invested in biopharmaceutical innovations. While biopharma and clinical care have received the most funding, the majority of companies are innovating in consumer goods and services (18), followed by virtual and hybrid care (13).

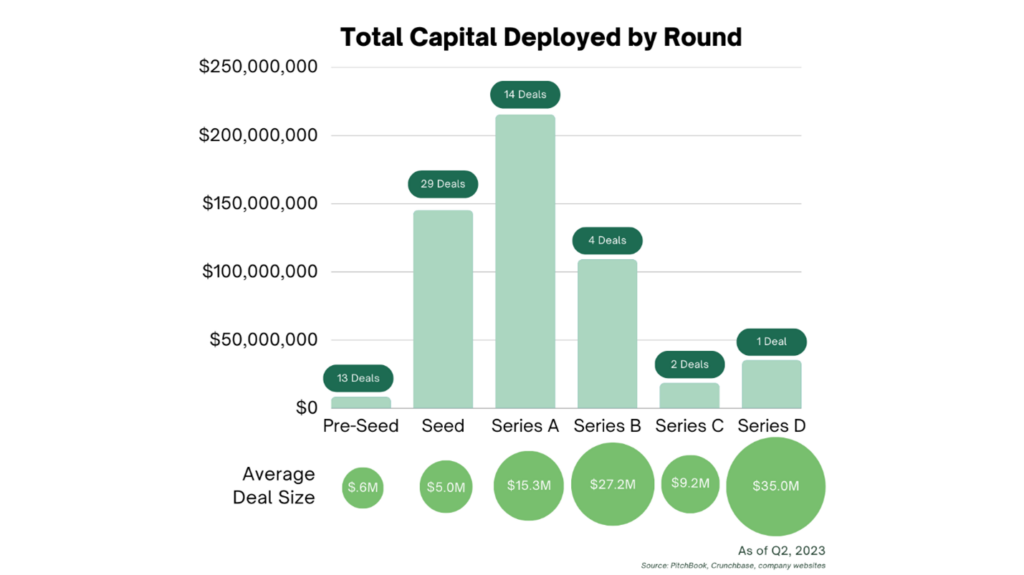

Perhaps unsurprisingly, given the relative recency in which menopause care first attracted funding, most companies have not surpassed a Series A round. From our data, it appears that just four companies have raised Series B rounds (Celmatix, Embr Labs, Alpha Health, and Peppy), two have raised Series C rounds (Celmatix, Embr Labs), and just one has raised a Series D round (Embr Labs).

Investment Implications

So, what does this investment landscape mean for venture capitalists and entrepreneurs?

First, menopause is an untapped market. Not only is menopause a $150B annual spending opportunity, 80% of healthcare dollars are controlled by women, meaning the people experiencing the problem are the same people deciding how to spend on healthcare costs. In addition, menopause is experienced by half of the world’s population at some point in their lives and the phase can last 2 to fourteen years, or on average roughly 7-10% of one’s life. People experience menopause at a greater rate than pregnancy or motherhood, yet patients consistently cite a lack of effective medical support and solutions to menopausal side effects. Therefore, it seems logical that companies solving for these challenges can reach a large audience with high spending power.

Menopause care remains a young, unproven industry. Most startups have not surpassed a seed or Series A round, and there are limited examples of successful exits. Of the 50 companies we identified, only three have been acquired: Menolabs, a consumer supplements company, was acquired by a biotech company in March ’22; Gennev, a virtual care clinic, was acquired by one of the largest women’s health companies in October ’22; Alva, a virtual care clinic distributing hormone replacement therapy, was acquired by Vira Health, a digital app in November ’22. Zero companies have gone public. Which means entrepreneurs are largely entering unchartered territory and investors will have to look to healthcare-adjacent sectors when considering exit opportunities.

Who pays for menopause care? That remains to be determined. Currently, most consumer goods, medical devices, and virtual and hybrid care companies are selling direct-to-consumer. Far fewer companies have locked in insurance or employer coverage. We anticipate that securing payers or employers will be challenging in the near term but will likely gain traction quickly over the next decade. Payers may be less apt to cover menopause care compared to innovations in chronic care (e.g. diabetes, COPD, kidney care) as menopause symptoms are often less acute and cost payers less in hospital stays or ER admissions. Employers, particularly in the U.S., have historically shown limited interest in offering menopause care benefits compared to other women’s health services such as fertility care.

However, we’re starting to see shifts in these trends. We’ve spoken to a few companies that are starting to pilot payer partnerships. And some employers are considering menopause care after understanding the economic impact (according to a recent Mayo Clinic study, menopause costs American women an estimated $1.8 billion in lost working time per year).[4] Mercer released a study earlier this year noting that 15% of employers intend to offer menopause care benefits in 2024, up from 4% in 2023.[5] At SJF, our hope is to see more menopause companies targeting insurance and employer coverage, as such coverage would ensure middle- to low-income Americans can access services that they otherwise could not afford.

As an aside, we’ll also be watching out for how menopause care companies compete against one-stop-shops such as Maven or Carrot Fertility. It remains to be seen whether employers will be more interested in specialty services with high-quality care or bundled packages that reduce point-solution fatigue.

The menopause market is an impactful play. Reducing the severity and length of menopause symptoms benefits not only the person experiencing the side effects but also their family and profession. And with each menopause care startup comes the opportunity to advocate for and make more visible a long-stigmatized condition. We at SJF Ventures are excited to see what’s to come for this market and look forward to backing an innovative, impactful menopause care company.

What companies did we miss in our landscape analysis? What perspective should be added to the discussion? We welcome your input.

Devon Sanford, dsanford@sjfventures.com

[1] https://www.menopause.org/docs/default-source/2014/nams-recomm-for-clinical-care

[2] https://www.oviahealth.com/blog/menopause/

[3] https://www.bloomberg.com/news/articles/2021-06-18/women-are-leaving-the-workforce-for-a-little-talked-about-reason

[4] https://www.nytimes.com/2023/04/28/well/live/menopause-symptoms-work-women.html

[5] https://www.mercer.us/our-thinking/healthcare/2023-benefit-strategies-report.html