SJF Updates Portfolio Carbon Impact Model

SJF is pleased to share details on portfolio carbon impact model additions and improvements, as well as updated results as of year end 2021.SJF Ventures is excited to share an update to its portfolio carbon impact model, which helps quantify portfolio companies’ ongoing impacts in mitigating carbon dioxide emissions. SJF first created the carbon impact model in 2016 following the signing of the Paris Agreement, and works to update the model annually to reflect company data from each year, recent scientific literature, policy changes, and new investments.

In 2021, SJF portfolio companies helped mitigate about 3 million metric tons of carbon dioxide, equivalent to taking more than 660,000 cars off the road for one year or planting approximately 50 million trees.

For the 2021 update, SJF partnered with a team of Executive MBA students at Duke University’s Fuqua School of Business. The Fuqua team incorporated extensive third-party research, refined and updated the existing model, and recommended next steps for portfolio companies to bolster their carbon mitigation efforts. The portfolio carbon mitigation results summarized above include the following updates to SJF’s model.

PosiGen is a residential solar platform that makes solar energy and energy efficiency upgrades available to all homeowners, regardless of income. The company primarily serves low-to-moderate income customers, offering both solar panel installations and energy efficiency improvement services. In 2021, PosiGen installed solar power in 3,350 homes across six states, with an average installation size of 6.68 kilowatts per home. PosiGen’s contribution was calculated using an average kilowatt hour power generation number based on peak sunshine rates in these six states and the company’s average installation size. PosiGen was included in SJF’s carbon model for the first time in 2021.

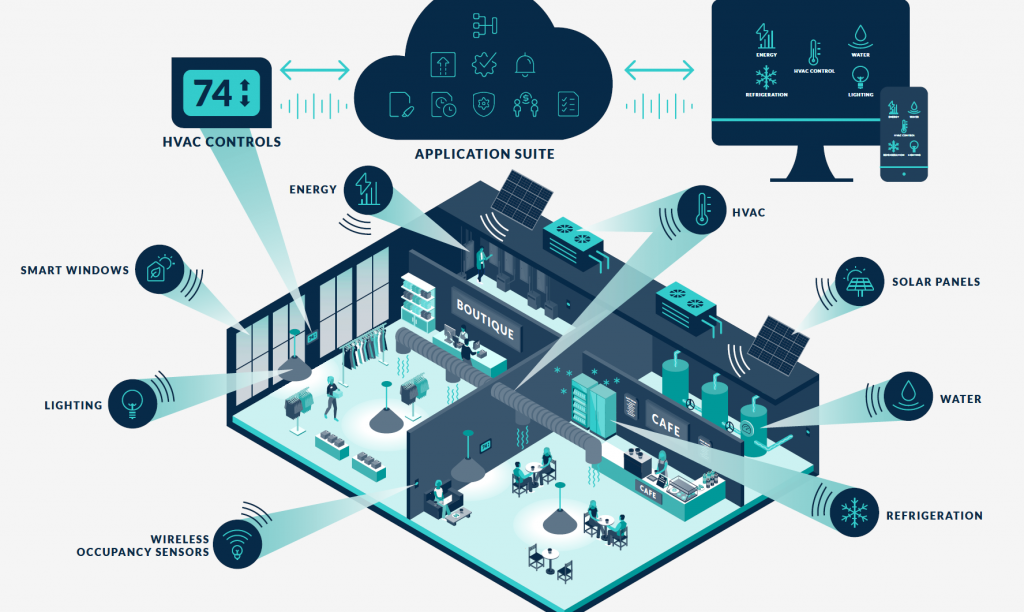

ENTOUCH Controls is a SaaS (software-as-a-service) company providing energy management systems for retail and restaurant chains that deliver immediate energy savings to users. Using location data from over 12,000 sites, the Fuqua team estimated the average metric tons of carbon dioxide saved per kilowatt hour based on sites’ locations relative to US electricity grids and associated carbon dioxide emissions in each grid. This refinement greatly improved the accuracy of the model, which was previously based on a nationwide average rather than being grid-specific.

Living Earth is a leading composting and organic material products company operating in Texas and Tennessee. The company’s 32 facilities collect yard waste, tree trimmings, and other organic materials from landscapers, residents, and municipal collections, presenting a more sustainable and cost-efficient alternative to disposing of these materials at local landfills. The organic waste is ground, mixed, and composted to produce a range of high-quality soil mixes, organic amendments, mulches, and composts that are demanded by regional landscapers, retailers, and residents. To ensure the accuracy of Living Earth’s contribution, the Fuqua team incorporated recent updates to the EPA’s Waste Reduction Model (WARM), which offers estimates of greenhouse gas emissions reductions associated with various types of waste management. The inclusion of WARM updates led to a 60% year-over-year increase in Living Earth’s estimated total carbon mitigation.

Additional citations and information about SJF’s carbon model can be found in the original publication about the project from 2015. The calculation of carbon emissions mitigated is not a comprehensive greenhouse gas accounting exercise, but rather a practice to understand portfolio companies’ positive environmental impacts and communicate gross carbon mitigation calculations from their primary business operations. The methodology employed follows available standard industry practices and incorporates the latest academic research, but unfortunately there is still minimal formal guidance on how to account for a company’s positive carbon mitigation. Thus, the portfolio carbon impact model is built using company-specific assumptions and reports total impact for the portfolio company, not a pro rata contribution based on SJF’s ownership stake. SJF accounts for mitigation during the time during which SJF has a direct stake in a portfolio company; values for exited portfolio companies are frozen as of the time of exit. Lastly, it is worth noting that the total reported mitigation number will increase due to a) existing portfolio company growth, and b) new investments in portfolio companies. In other words, mitigation growth comes from both the scaling of our existing investments and the new mitigation from additional investments throughout 2021.

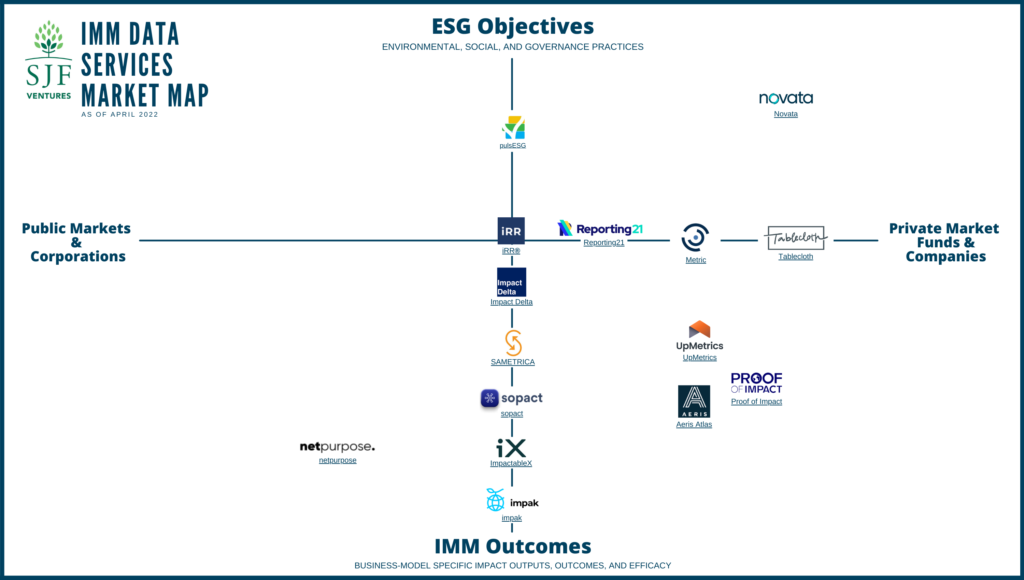

SJF is working to calculate carbon emissions of its operations and portfolio companies in addition to the aforementioned mitigation efforts. To better understand SJF’s carbon footprint, or the total aggregate emissions we are responsible for as a firm, we have partnered with Persefoni. Through our work with Persefoni, we are undertaking a comprehensive greenhouse gas accounting exercise that will assess our firm-wide operations and financed emissions.

SJF portfolio companies included in the carbon impact model:

BioSurplus (Now Copia Scientific)

Community Energy (Acquired by AES)

groSolar (Acquired by EDF Renewables)

Hyla Mobile (Acquired by Assurant)

Nextracker (Acquired by Flex)

Novinium (Acquired by Southwire)

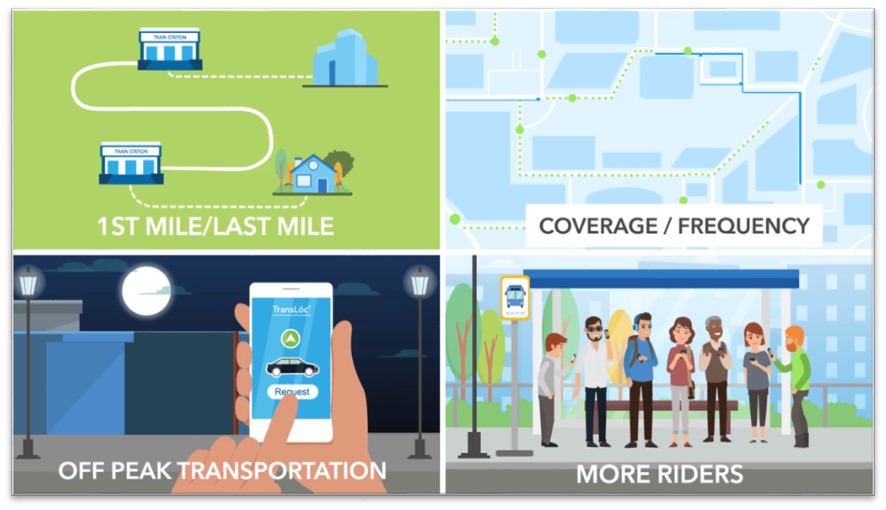

TransLoc (Acquired by Ford Smart Mobility)

A special thanks to the Fuqua team – Kristen Bridgers, Ankur Gandhi, Yanlin Li, Dharma Subramanian, and Amanda Vigneaud – for their contributions to the 2021 carbon model updates.